In addition, as the search for yield will likely remain a key driver for both retail and institutional investors in the 4Q, high divided-yielding stocks will also continue to outperform the market, in our view. A list of our top picks is reflected in table below, which includes “buy on weakness” tactical stocks.

Which Sector to look at?

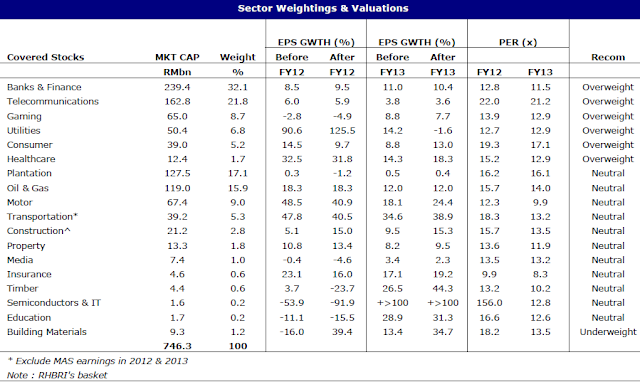

Sector-wise, our key overweights are telecommunications and banking, although we also have an overweight stance on the consumer, utilities, gaming and rubber gloves under the healthcare sector (see table below). We expect the high-yielding telecommunications stocks to remain relatively defensive for equity investors under the current market environment.

The banking sector, on the other hand, carries a 34.7% weighting in the bellwether index and, in our view, cannot be ignored, given the better-than-expected recovery in earnings momentum over the last two consecutive quarters. The year-to-date annualized loan growth stood at 11.9%, ahead of our and the consensus forecasts of 10-11% and 8-9% and the pipeline of corporate deals remains healthy. This suggests that banking earnings could continue to surpass expectations in the quarters ahead, which coupled with decent valuations and dividend yields vis-a-vis the FBM KLCI benchmark, would bode well for share price performance in the 4Q, in our view.

Source: RHBRI research report